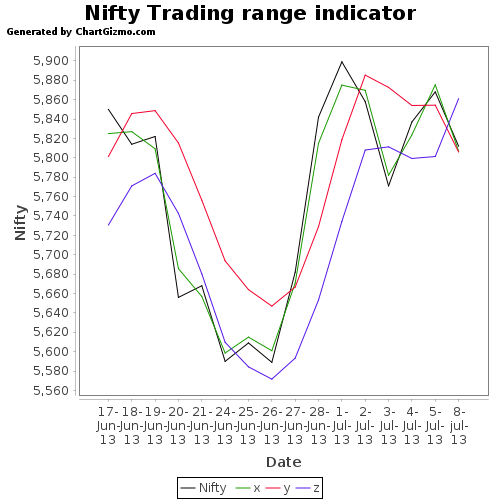

Most of the time, the Nifty trades between and around x,y & z

Whenever the Nifty crosses above all 3, a correction sets in sooner than later and vice versa when the Nifty goes below all 3.

This technique has been back-tested for the last 1300+ trading days with consistent accuracy.During periods of sustained rallies and extended corrections - the 3 variables - x,y&z stood as signposts for probable Nifty levels.

When the Nifty manages to hold itself above all 3, keep the trailing stop loss at the highest of the 3 variables - x,y & z.

Similarly,when the Nifty is below all 3, the variable immediately above the Nifty acts as a Resistance for the index.

Most of the time, the Nifty trades between and around x,y & z

Whenever the Nifty crosses above all 3, a correction sets in sooner than later and vice versa when the Nifty goes below all 3.

This technique has been back-tested for the last 1300+ trading days with consistent accuracy.During periods of sustained rallies and extended corrections - the 3 variables - x,y&z stood as signposts for probable Nifty levels.

When the Nifty manages to hold itself above all 3, keep the trailing stop loss at the highest of the 3 variables - x,y & z.

Similarly,when the Nifty is below all 3, the variable immediately above the Nifty acts as a Resistance for the index.

NOTE-Black line is Nifty.

No comments:

Post a Comment